AM Grind: Trillions in Debt? What Does It All Mean?!

We'll first take a refresher course on what the Federal Debt actually is.

America Mission’s Patrick Rafferty with Pat Riotism of course covered much more than the debt ceiling on the May 31st AM Grind.

But with a topic so huge, it screamed for its own wrap up.

==> The space can be heard in it’s entirety on Twitter: May 31st AM Grind

or listen here directly:

The remaining topics were covered in this SubStack write-up:

So, with that, let’s begin:

Can You Even Fathom that Our Country is $31 Trillion Dollars in Debt?

There are votes in the house and the senate that are happening in the next couple of days. We need to stand up against this. Just for perspective, Federal Budget in 2019 was 4.7 Trillion, the proposal today is 6.4 Trillion, AFTER THE pandemic...

As Joe biden would say, "Come on, Man"... ~P.R.

From U.S. Debt: Visualizing the $31.4 Trillion Owed in 2023:

What does this even mean?

With the help from U.S. Government Accountability Office, Foreign ownership of U.S. debt through Treasury holdings and other linked sites, here we go with the basics:

How the Federal Government Borrows Money:

The federal government borrows money from the public by issuing securities—bills, notes, and bonds—through the Treasury.

What is the U.S. National Debt?

The national debt ($31.46 T) is the total amount of outstanding borrowing by the U.S. Federal Government accumulated over the nation’s history. It is made up of Public Debt and Intragovernmental Debt.

Fun fact: The interest on this debt? 2.5 trillion!

Public Debt?

Also referred to as public interest, government debt, and sovereign debt, as of May 25, 2023, $24.6 trillion of the $31.4 trillion national debt is public debt. It is held by individuals, U.S. banks, corporations, state or local governments, the Federal Reserve, foreign governments, mutual funds, pensions funds, insurance companies, and holders of savings bonds and other entities outside the U.S..

How much US debt do foreign governments own?

Then what is Intragovernmental Debt?

The Treasury owes this part of the debt to other federal agencies. Intragovernmental holdings totaled more than $6.89 trillion in January 2023.

Some agencies, like Social Security, take in more revenue in taxes than they need.

Agencies use the excess to ‘buy’ US Treasury Notes.

The US Treasury puts the money into the general fund.

When needed, the Agencies’ Notes are redeemed for funds.

The federal government then either raises taxes or issues more debt to raise the required cash.

Now We Get to the Infamous Debt Ceiling

The debt ceiling, or debt limit, is a restriction imposed by Congress on the amount of outstanding national debt that the federal government can have. The debt ceiling is the amount that the Treasury can borrow to pay the bills that have become due and pay for future investments. Once the debt ceiling is reached, the federal government cannot increase the amount of outstanding debt, losing the ability to pay bills and fund programs and services. However, the Treasury can use extraordinary measures authorized by Congress to temporarily suspend certain intragovernmental debt allowing it to borrow to fund programs or services for a limited amount of time after it has reached the ceiling.

The Debt Limit Through the Years (graphic at link)

Bipartisan Policy Center has compiled a timeline of notable events in the history of the debt limit from its inception 100 years ago.

The Notable Notables

July 1939 The First Federal Debt Limit is $45 billion. Congress consolidates limits on specific forms of debt (e.g., separate caps on bonds and shorter-term debt) into one aggregate debt limit. It gives the Treasury Department wide discretion over what borrowing instruments to use so long as total debt does not exceed that level.

1974 The Congressional Budget and Impoundment Control Act of 1974 creating the modern congressional budget process. The law gives Congress new tools to control spending by the executive branch.

1982 The Federal Debt Limit Is Officially Codified into Law Prior to this point, all changes in the federal debt limit were legislated as amendments to the Second Liberty Bond Act of 1917.

1985 Treasury Department Implements “Extraordinary Measure”

Treasury Department for the first time implements so-called “extraordinary measures,” accounting maneuvers that allow the government to continue meeting federal obligations. The measures can included temporarily “disinvesting” certain federal accounts.

1986 Policymakers Formally Authorize the Treasury Secretary to Use Extraordinary Measures which legally permits the Treasury Secretary to depart from normal investment practices for certain trust funds in order to prevent the federal government from exceeding the debt limit (excludes Social Security trust funds).

2002 Policymakers Return to Deficit Spending

Feb 2013 No Budget, No Pay Act of 2013, is passed. This episode is the first time in the debt limit’s history that it is addressed via a temporary suspension rather than a specified numerical increase in the limit.

October 2013 The federal government undergoes a 16-day partial shutdown after Congress fails to enact either appropriations bills or a continuing resolution, the result of disagreements surrounding funding for the Affordable Care Act.

2014 Debt Limit Is Reinstated at $17.2 Trillion

2015 The Bipartisan Budget Act of 2015 suspends the statutory debt limit through March 15, 2017; also loosens the spending caps on defense and domestic discretionary spending.

2017 Debt Limit Is Reinstated at $19.8 Trillion

2019 Debt Limit Is Reinstated at $22 Trillion

Oct 2021 Debt Limit is Raised to $28.9 Trillion

Dec 2021 Debt Limit is Raised to $31.4 Trillion

Jan 2023 The Debt Limit is Reached…Again On January 19, 2023, Treasury hits its $31.4 trillion debt limit and deploys extraordinary measure.

Borrowing Keeps Going Up Right Along with the Budget

Money for federal spending primarily comes from government tax collection and borrowing.

The funny-not-funny thing is that we spend more than we take in; in other words operating at a budget-deficit. The US has been doing that since 2001!

The United States issues Treasury Bonds (recall that these are part of the Federal Debt) to cover the deficit.

T-Bonds are twenty-year (or greater) loans from citizens to the government; the citizen gets paid interest payments semiannually. They are issued at monthly online auctions held directly by the U.S. Treasury, and the bond's price and yield are determined during the auction.

Fun fact: The interest paid is considered income and is taxed at the federal level.

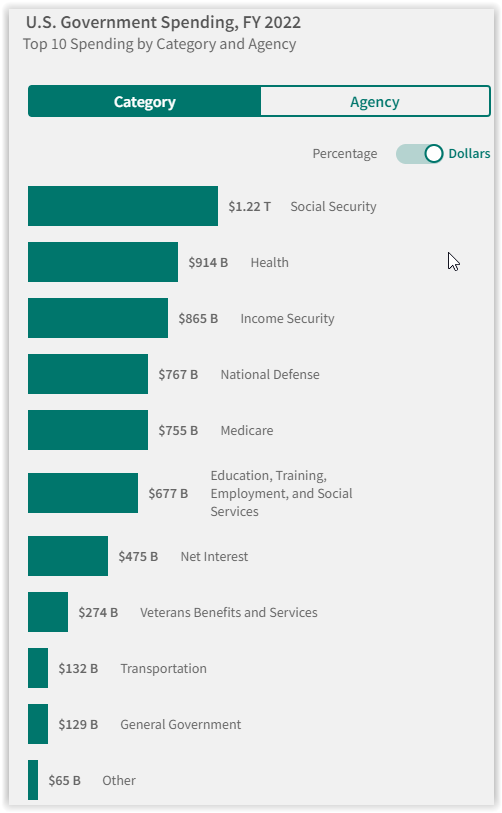

What makes up the budget?

U.S. Constitution gives Congress the ability to create a federal budget. This is the source of the salaries paid to federal employees and contractors, the dispersal of agricultural subsidies, and the equipment purchased by the U.S. military, among many other endeavors. It is divided into three categories: mandatory spending, discretionary spending, and interest on the national debt.

Switch to %s here.

The Deadline is June 5th on Defaulting. Now What?!

The legislators are squabbling and negotiating the game plan to increase the current debt ceiling or kick-the-can down the road (again) having the 119th Congress deal with it. One would think logically the best thing to do is decrease the spending in order not to hit the debt limit next time, with clear cut provisions and requirements.

Heritage Foundation: Here Are the Real Losers in the Debt Ceiling Agreement

Senator Rand Paul offers an alternative to the current Debt Ceiling ‘Biden McCarthy’ Deal.

This alternative will be offered as an amendment to the so-called “Fiscal Responsibility Act” deal and would replace existing language with responsible reforms and necessary cuts.

The House of Representatives is on track to vote Wednesday on a bill to suspend the nation’s debt limit through January 1, 2025.

Earlier Wednesday, the chamber cleared a key hurdle to advance to a final vote when it approved a rule governing floor debate for the debt limit bill. The House has passed the rule governing floor debate for the debt ceiling bill.The tally was 241 to 187, with 29 Republicans voting “no” and 52 Democrats voting “yes.” Passage of the rule clears the way for a final House vote on the debt ceiling bill this evening.

It won't fix the deficit: While the bill at hand will accomplish the important task of neutralizing the debt ceiling as a bargaining chip, it is not designed to do much of substance about controlling the spending that created the debt in the first place. Lawmakers exempted from the talks spending on Social Security, which currently accounts for 19% of US spending; Medicare, 12% of spending; and national defense, 12% of spending.

==> To be clear there would be no limit to the debt until “x” date - which is after the next Presidential election!

US House of Representatives holds final vote of debt ceiling bill –

watch live

UPDATE 05.31.23 10:00pm EST

The House has passed the debt limit deal to suspend the nation’s debt ceiling through January 1, 2025.

The final tally for the vote was 314 to 117.

FOR: 149 Republicans and 165 Democrats voted for

AGAINST: 71 Republicans and 46 Democrats

The bill will next need to be passed by the Senate. Vote date TBD.

UPDATE 06.01.23

The US Senate has passed the Fiscal Responsibility Act of 2023 by a bipartisan vote of 63-36. It enables the US to pay existing debts that both parties have accumulated over many years through demands for higher spending on domestic and military programs, as well as lower taxes. Extending the debt ceiling does not authorize new spending; it enables the US to pay existing debts that both parties have accumulated over many years through demands for higher spending on domestic and military programs, as well as lower taxes.

UPDATE 06.03.23

Biden Signs Debt Ceiling Bill, Ending Monthslong Political Battle

President Joe Biden signed the Fiscal Responsibility Act on Saturday, suspending the debt ceiling for 19 months and bringing a monthslong political battle to a close.

Editor’s Snark:

Somehow I see the Biden Administration and Congress doing the Money Dance.